“Probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Depending on the amount and type of property the deceased person owned, you may or may not need to go to court to transfer or inherit the property. All of the property legally owned by the deceased person is called the person’s “estate.” If you need to go to court, this is commonly called "going through probate." A person's estate may need to go through probate even if they had a will.”

What is Probate?

Probate Is Not Always Bad

When Someone Dies Without a Will

If a person dies without a will (intestate), the probate court oversees the distribution of assets according to state law. The court appoints an administrator to manage the estate. Once appointed, the administrator receives Letters of Administration, granting legal authority to act on behalf of the estate.

When There Is a Will

If a person dies with a valid will (testate), the court must confirm its validity—ensuring it was properly signed, witnessed, and free from fraud or undue influence. Once approved, the court issues Letters Testamentary to the named executor, authorizing them to administer the estate. The probate court can act as a referee to settle potential disputes among heirs regarding how the will should be interpreted and assets distributed.

Probate Can Be Expensive

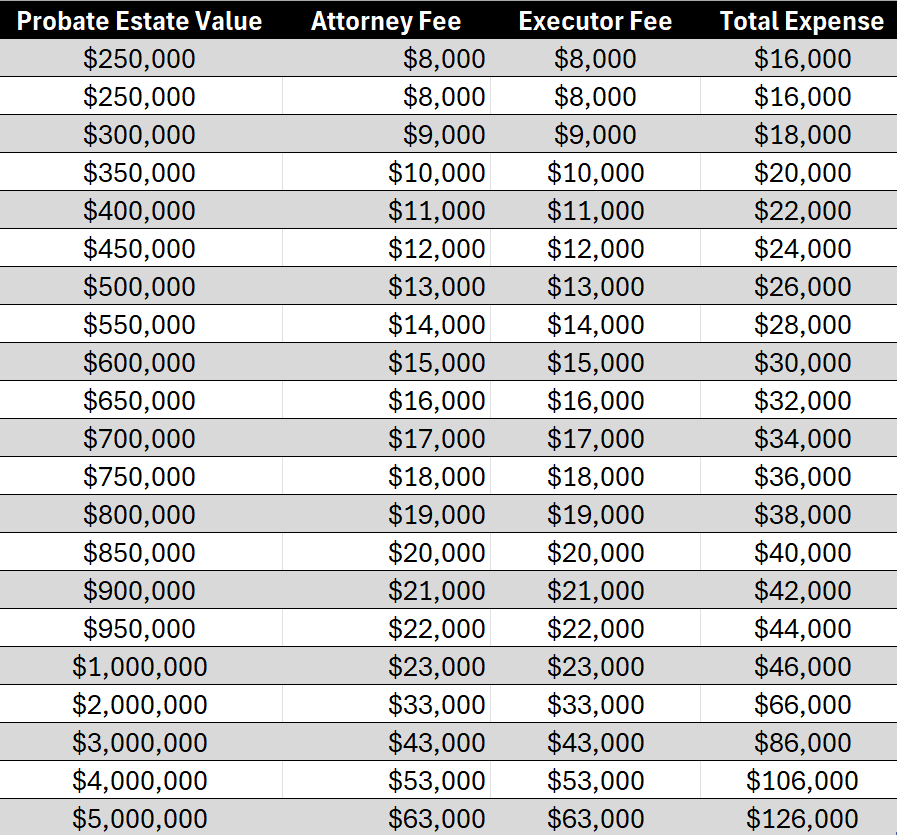

In California, compensation for probate services is governed by Probate Code §10810. Both Attorneys and Executors (or Administrators) are entitled to statutory fees based on the gross value of the estate, calculated using the following tiered formula:

4% of the first $100,000

3% of the next $100,000

2% of the next $800,000

1% of the next $9 million

The table below estimates potential statutory fees for both the attorney and the executor or administrator, based on the value of the probate estate.

Probate Fee Table

Effective estate planning can substantially reduce, or even eliminate, the costs associated with probate administration. By establishing a living trust and utilizing other strategic planning tools, you may be able to minimize the portion of your estate that is subject to probate proceedings.

Call my office or email us today for a complementary, one-hour consultation to discuss strategies.